The market for digital retirement planning tools has really matured. It’s no longer just about adding more features or capabilities. Now, what matters most is trust, security, and providing a smooth, helpful digital experience for users.

This shift is clearly outlined in the J.D. Power 2025 U.S. Retirement Plan Digital Experience Study. The study, which gathered feedback from 7,151 retirement plan participants between May and June 2025, gives us a fresh look at what today’s retirement savers really care about.

Contents

- 1 Security Takes the Spotlight: A Big Shift in What Users Care About

- 2 The “Satisfaction Gap”: Who’s Leading and Who’s Falling Behind

- 3 The Need for a Smoother Experience: Why Integration and Support Matter More Than Ever

- 4 How We’re Evaluating the Top Retirement Planning Apps of 2025

- 5 Deep-Dive Analysis of Market-Leading Platforms

- 5.1 Empower Personal Dashboard: The Premier Financial Aggregator

- 5.2 Fidelity: The One-Stop Shop for Serious (and Everyday) Investors

- 5.3 Vanguard: The Low-Cost Investing Giant with a Split Digital Personality

- 5.4 Boldin (formerly NewRetirement): The Power Tool for Serious DIY Retirement Planners

- 5.5 Betterment: The Robo-Advisor for Easy, Goal-Driven Investing

- 6 Comparing the Top Platforms and What It Means for You

- 7 Recommendations Based on What You Need

- 8 Conclusion

Security Takes the Spotlight: A Big Shift in What Users Care About

The biggest takeaway from the 2025 J.D. Power study is clear: security has become the top priority for users. In fact, 62% of people say they care more about security than convenience when using a retirement platform.

This marks a big change in how users think. For years, tech was all about making things as easy and seamless as possible; anything that slowed you down, like an extra login step, was seen as a flaw. But now, with retirement savings on the line, security is the new priority.

Security is now just as important as how easy a platform is to use or how fast it works. People aren’t just putting up with extra security steps; they want them.

As Kapil Vora from J.D. Power puts it, “retirement plan account holders are willing to accept extra authentication steps and actively seek signs of strong data security.”

So, what was once seen as an inconvenience is now a sign that a platform is taking its savings seriously. If a platform doesn’t have strong security, users lose trust fast, showing that trying to make things too convenient at the expense of security can backfire.

Also See: 10 Expat-Friendly Cities Where You Can Actually Live Like a Millionaire on Just $1,500 a Month

The “Satisfaction Gap”: Who’s Leading and Who’s Falling Behind

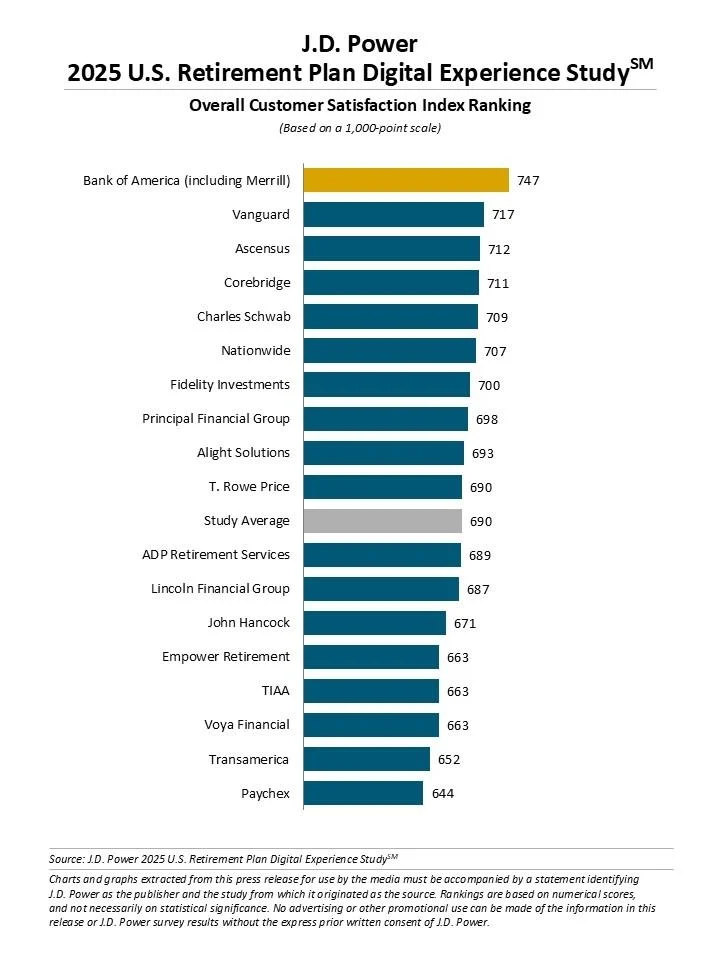

The J.D. Power study highlights a big difference in the quality of digital experiences across retirement plan providers. There’s a massive 103-point gap between the top performer and the lowest scorer on the 1,000-point scale. This shows a market split between companies that have invested wisely in their digital services and those that are lagging behind.

At the top, we see clear leaders. The five top-rated providers for digital experience satisfaction in 2025 are:

- Bank of America (including Merrill) – 747

- Vanguard – 717

- Ascensus – 712

- Corebridge – 711

- Charles Schwab – 709

On the other end, Paychex scored just 644, highlighting a huge difference in user experience. This gap suggests that the provider you choose can really affect how well and confidently you can manage your retirement savings.

The Need for a Smoother Experience: Why Integration and Support Matter More Than Ever

Aside from security, the J.D. Power study points to two major pain points for users: poor integration across devices and a lack of proactive support.

Nearly half of users (45%) say their experience isn’t consistent between platforms, like using the desktop site vs. the mobile app. Things don’t always sync well, and the design often feels disjointed. That breaks the flow and creates frustration, especially for users who expect a seamless experience wherever they log in.

Even more telling, 61% of retirement plan participants feel the digital tools they’re using fall short when it comes to offering helpful, proactive guidance. People don’t just want to see numbers; they want their app to guide them. They’re looking for smart, personalized suggestions that help them make better financial decisions, not just static dashboards.

This gap in functionality is also a big opportunity. Platforms that go beyond basic info and provide real-time, tailored insights are much more likely to earn user trust and loyalty.

Because these digital tools are often offered through workplace retirement plans, a bad experience doesn’t just reflect on the platform; it reflects on the employer. The study actually measures how much a user’s experience with their retirement app affects their view of their company.

In a tight job market where benefits really matter, offering a clunky or confusing 401(k) app can hurt a company’s reputation and even its ability to keep or attract talent.

How We’re Evaluating the Top Retirement Planning Apps of 2025

To fairly compare the top retirement planning apps in 2025, we need a clear, consistent framework. This lets us judge each app on what really matters to users, based on research and feedback. We’ve broken it down into five key categories:

Planning and Forecasting Tools

This looks at how powerful and user-friendly each app’s planning tools are. We’re talking about things like retirement calculators, future projections (like Monte Carlo simulations), and “what-if” scenarios to help you plan for different financial outcomes.

We also check for more advanced tools, like help with Social Security timing, Roth conversions, and estimating healthcare costs in retirement.

Investment Options and Flexibility

Here, we evaluate how well the app helps you grow and manage your money. We look at the range of investments available—mutual funds, ETFs, stocks, even crypto, as well as which types of accounts you can manage (like IRAs, 401(k)s, and taxable accounts).

We also assess the level of automation (like rebalancing and tax-loss harvesting) and whether you can get help from a human advisor or a robo-advisor.

Ease of Use and Design

This is all about the user experience. Is the app easy to navigate? Are the dashboards clear? Can you connect all your accounts in one place without a headache? We also check whether the app works just as smoothly on your phone as it does on your computer..

Security and Privacy

Security is a top concern for users in 2025, so this category looks closely at how well your data and money are protected. We check for multi-factor authentication, strong encryption, insurance coverage (like FDIC or SIPC), and clear, transparent privacy policies.

Cost and Overall Value

Finally, we examine what the app costs and whether it’s worth it. We look at everything from subscription fees to investment-related charges (like AUM fees or fund expense ratios), as well as any hidden costs.

Then we weigh those against the features and benefits the app offers to determine if you’re getting good value.

Read: These 12 Islands Let You Retire Rich With Zero Income Tax (Keep Every Cent!)

Deep-Dive Analysis of Market-Leading Platforms

Empower Personal Dashboard: The Premier Financial Aggregator

Empower Personal Dashboard (formerly known as Personal Capital) stands out as one of the best tools for getting a complete view of your finances in one place. It securely links all your accounts: checking, savings, credit cards, 401(k)s, IRAs, investments, loans, and more, so you can see your full financial picture and real-time net worth on a single dashboard.

Empower’s strength goes beyond just tracking your money. Its built-in Retirement Planner lets you run “what-if” scenarios to see how different decisions, like retiring early or changing your savings rate, might affect your future. You’ll get a personalized estimate of your retirement income, plus tools to help with goal tracking, savings, and budgeting.

Though the dashboard is mainly a free planning tool, Empower is also a full-service investment firm. That means you can get a detailed analysis of your investments, including your asset mix, risk levels, and hidden fees. While Empower offers optional paid advisory services, using the dashboard doesn’t require signing up for them.

Users regularly highlight how clean and easy to use the app is. The dashboards are visually appealing, fast, and designed to make complex info easy to understand. Plus, your linked accounts update automatically, no manual entry needed, so you’re always seeing an up-to-date financial snapshot.

Because Empower connects to so many sensitive accounts, security is a major focus. The platform uses strong encryption and requires multi-factor authentication. Some users even mention that cybersecurity professionals have recommended it, which speaks volumes about its reputation.

The biggest win? It’s free. You get access to powerful planning and tracking tools without paying anything. While Empower does offer paid wealth management services, there’s no hard sell; many users report being able to use the free tools with no pressure to upgrade.

Fidelity: The One-Stop Shop for Serious (and Everyday) Investors

Fidelity is a financial giant that offers pretty much everything under one roof: brokerage accounts, IRAs, 401(k)s, cash management, and retirement planning. Whether you’re just getting started or already managing a complex portfolio, Fidelity is designed to be your all-in-one financial platform.

Fidelity gives users free access to retirement planning tools that are flexible and easy to track through its online platforms. You can set personal goals and monitor your progress, with help from Fidelity’s AI-powered Virtual Assistant to answer questions along the way.

While the planning tools are solid, they aren’t as deeply promoted or specialized as some standalone retirement-focused apps. This is where Fidelity really shines. It offers:

- $0 commissions on online U.S. stock and ETF trades

- Over 3,300 mutual funds with no transaction fees

- Its own line of Fidelity ZERO index funds, with absolutely no expense ratio

Fidelity also includes top-notch research tools and supports everyone from first-time investors to seasoned traders.

Fidelity’s app is highly rated. 4.8 stars on the App Store and 4.6 on Google Play. It strikes a good balance: full of features for power users, but still intuitive for those who just want to check their retirement balance or place a basic trade.

That said, some users have noted that recent app updates made things a bit harder to navigate, so it’s still a work in progress in terms of UI refinement.

Fidelity has a strong reputation for security. It uses encryption, firewalls, multi-factor authentication, and even biometric login options for mobile users.

On top of standard SIPC insurance, it offers a Customer Protection Guarantee, promising to reimburse users for any losses due to unauthorized account activity.

Fidelity delivers huge value. There are no fees to open or maintain most accounts, no minimums, and zero commissions on most trades. For the average investor, that means you get access to professional-grade tools and services without paying extra for them.

Vanguard: The Low-Cost Investing Giant with a Split Digital Personality

Vanguard is a pioneer in long-term, low-cost investing. It built its reputation on offering ultra-low-fee index funds and ETFs, encouraging a “buy-and-hold” strategy for retirement savers.

If you’re in it for the long haul and cost is your biggest concern, Vanguard is likely already on your radar. Vanguard offers solid tools to help users plan for retirement. You’ll find:

- A basic Retirement Income Calculator for simple projections

- A more advanced Tax-Efficient Retirement Strategy tool, which uses Monte Carlo simulations to help with tough decisions like:

- When to claim Social Security

- Whether to do Roth conversions

- How to withdraw from accounts in a tax-smart way

This shows Vanguard is thinking about both sides of retirement, the saving and the spending.

This is where Vanguard leads the pack. They’re the original champions of low-cost index funds and still set the standard. Their focus is on long-term investing, not day trading or advanced strategies, so the platform isn’t built for active traders. But if your goal is to grow your wealth steadily and keep fees low, it’s hard to beat.

Vanguard scores very well in the J.D. Power rankings for workplace retirement plans, landing at #2 overall. That part of their platform, used by employer-sponsored plans, has clearly benefited from recent upgrades like a sleek new dashboard and better mobile functionality.

But individual investors using Vanguard’s retail platform often tell a different story. The consumer-facing website and app are frequently described as outdated, clunky, and sometimes buggy. Many users also report frustrating customer service experiences.

So, there seems to be a split: one modern, polished experience for employer-plan users, and a less refined one for everyone else.

Vanguard uses the standard security tools you’d expect: encryption, secure login, identity verification questions, and alerts for account activity. While it’s solid, it doesn’t go above and beyond compared to more security-forward platforms.

Here’s where Vanguard shines the brightest. Its expense ratios are among the lowest in the industry, which can make a huge difference over the long run.

While there may be small account maintenance fees in some cases (like a $25 annual fee on certain accounts), these are often waived if you opt for e-delivery or meet account minimums. For investors focused on minimizing costs, Vanguard remains the go-to choice.

Boldin (formerly NewRetirement): The Power Tool for Serious DIY Retirement Planners

Boldin is a specialized platform built for people who want full control over their financial future. Unlike most tools, it’s not a brokerage; it’s a powerful modeling engine designed to help you plan, test, and optimize every detail of your retirement strategy.

It gives users the ability to model incredibly detailed “what-if” scenarios, everything from Roth conversions and Social Security timing to real estate sales, healthcare costs, debt strategies, and more. It also includes advanced tax analysis at both the federal and state levels.

Boldin recently added a Financial Wellness Dashboard, which gives you a holistic score based on over 20 financial metrics, offering a quick snapshot of your overall financial health.

Boldin doesn’t manage your investments, but with the PlannerPlus subscription, you can securely link your external accounts (like banks and brokerages). This allows the platform to pull real-time data into your plan for even more accurate projections.

If you want help from a human expert, the Boldin Advisors tier connects you with a CERTIFIED FINANCIAL PLANNER™ for one-on-one guidance, including portfolio analysis and investment recommendations.

Boldin is designed for users who like to dig deep into the numbers. It’s not the flashiest interface out there, but it’s clear, informative, and focused on helping you make smart, informed decisions.

One standout feature is the “Retirement Chance of Success” score, which updates dynamically as you tweak your plan, so you can instantly see the impact of your changes.

Boldin takes security seriously. It uses 256-bit encryption, follows strict SOC2 compliance standards, and supports multi-factor authentication. Just as importantly, it has a firm policy against selling your data.

Boldin follows a freemium model. The basic planner is free and already quite capable. But to unlock its full power, the PlannerPlus subscription costs $144 per year. That gives you access to:

- Linked accounts for real-time tracking

- Advanced tax and Roth conversion modeling

- Monte Carlo simulations

- The ability to create and compare multiple retirement scenarios

For DIYers who want advisor-level insight without paying advisor-level fees, Boldin offers outstanding value.

Betterment: The Robo-Advisor for Easy, Goal-Driven Investing

Betterment is a top robo-advisor that takes the hassle out of investing by automating the whole process. It builds expert-designed, globally diversified portfolios using low-cost ETFs, tailored to your personal goals.

Betterment is all about helping you reach specific financial goals, like retirement, by giving you tools to track your progress and personalized portfolio recommendations based on your timeline and risk tolerance. It also includes projections that show how much you need to save to hit your targets.

This is Betterment’s bread and butter. It automates everything from initial investments to regular portfolio rebalancing, dividend reinvestment, and even tax-loss harvesting (which can help reduce your tax bill and boost returns). This “set it and forget it” style is perfect if you want a hands-off, worry-free investing experience.

Betterment’s app is clean, simple, and easy to use, ideal for beginners or anyone who wants to invest without complexity. It scores high ratings on both the iOS App Store (4.8 stars) and Google Play Store (4.7 stars).

Betterment takes security seriously, using 256-bit SSL encryption and two-factor authentication to protect your account. As a registered fiduciary, it’s legally required to put your interests first. Plus, client assets are held with a third-party custodian and backed by SIPC insurance.

Betterment’s pricing is straightforward. The standard Digital plan charges 0.25% per year of your assets (or $4/month for smaller accounts).

If you have more than $100,000 invested, the Premium plan costs 0.40% per year and gives you unlimited access to human CERTIFIED FINANCIAL PLANNER™ advisors.

Comparing the Top Platforms and What It Means for You

Looking at these five leading retirement apps, it’s clear the market isn’t heading toward one “perfect” all-in-one solution. Instead, two main approaches are shaping up.

On one side, you have platforms like Empower and Boldin that focus on doing one thing really well. Empower on bringing all your finances together in one place, and Boldin on detailed, hands-on planning. These apps work best as part of your existing financial setup.

On the other side, big players like Fidelity and Vanguard want to be your one-stop shop for everything financial, offering a full range of services all in one place.

Then there’s Betterment, which sits in the middle, providing a bundled, automated investment service that fits into your bigger financial picture.

The “best” retirement app really depends on what you need and how you like to manage your money. Everyone’s different, so the right choice is personal.

Quick Comparison Table

Here’s an easy-to-read table that compares the five platforms side-by-side, based on the most important features and value they offer. It’s meant to help you quickly see the differences and make a smart choice.

Feature

Empower Personal Dashboard

Fidelity

Vanguard

Boldin (NewRetirement)

Betterment

Primary Function

Holistic financial aggregation and net worth tracking

Full-service, all-in-one financial provider (investing, banking, planning)

Low-cost, long-term investment management (index funds/ETFs)

Specialized, in-depth DIY retirement planning and scenario modeling

Automated, goal-based robo-advisory and investment management

Key Planning Tool

Retirement Planner with scenario analysis and fee analyzer

Free, personalized financial plan and goal-setting tools

Tax-Efficient Retirement Strategy tool with Monte Carlo simulation

“What-if” scenario engine, Roth conversion & tax modeler

Goal-based projection tools and personalized allocation advice

Security Highlights

Multi-layer security, encryption, MFA. Recommended by security experts.

MFA, biometric login, SIPC, and Customer Protection Guarantee.

Encryption, SSL validation, account alerts.

Bank-level security, 256-bit encryption, MFA, SOC2 compliant.

256-bit SSL encryption, 2FA, SIPC insurance, SEC-registered fiduciary.

Cost Model

Free dashboard and tools. Paid advisory services are optional.

$0 account fees, $0 commissions on most trades.

Extremely low fund expense ratios. Some account fees may apply.

Freemium model. PlannerPlus is $144/year.

0.25% AUM annual fee ($4/month for small balances).

J.D. Power Rank (Workplace)

Not Ranked

Profiled, Not Ranked in Top 5

#2 (Score: 717)

Not Applicable

Not Applicable

Ideal User Profile

The Holistic Net Worth Tracker

The All-in-One Consolidator

The Cost-Conscious Boglehead

The Data-Driven DIY Planner

The Hands-Off Novice

Recommendations Based on What You Need

After looking at all the platforms, here’s a quick guide to help you pick the best one depending on your style and goals:

The Hands-Off Beginner:

You want something simple, easy to use, and mostly automatic. No fuss, just set it and forget it.

Best Pick: Betterment. It handles the investing for you with automated management, rebalancing, and tax-saving moves. The app is super friendly, making it great for beginners who want to stay on track without stress.

The All-in-One Organizer:

You want everything in one place, checking, credit cards, investments, retirement, all under one roof with smooth integration.

Best Pick: Fidelity. It offers a full range of services, no commissions on many trades, strong planning tools, and top-rated apps. It’s the go-to if you want one powerful, connected platform.

The Data-Driven DIYer:

You like digging into the details, running different scenarios, and having full control over your retirement plan.

Best Pick: Boldin. It’s the most detailed and flexible tool out there for serious planners who want to test different strategies and get deep insights.

The Holistic Tracker:

You just want a clear, up-to-date snapshot of your entire financial picture, all your accounts in one place.

Best Pick: Empower Personal Dashboard. Its aggregation tools are top-notch, giving you a real-time view of your net worth and helpful planning tools, all for free.

The Cost-Conscious Investor:

Your main goal is to keep costs as low as possible, even if the app isn’t the flashiest. You care most about maximizing your long-term returns.

Best Pick: Vanguard. It’s the king of low-cost index funds and ETFs, perfect if you want to minimize fees and focus on long-term growth, even if the user experience isn’t fancy.

Conclusion

The retirement planning app world is diverse and packed with strong options that cater to all kinds of users and financial styles.

Security has become a must-have for earning user trust, and while there’s still a big difference between the best and worst digital experiences, the top platforms are clearly focused on giving users smart, powerful tools.

There’s no one-size-fits-all “best” app. The right choice depends on your personal finances, how comfortable you are with technology, and how you like to manage your money.

The market offers two main paths: specialized apps that do one thing really well, and all-in-one platforms that cover everything. Knowing what kind of user you are, whether you want simplicity or total control, will help you pick the platform that fits you best and supports your financial goals.